does south dakota have sales tax on vehicles

City Governments have the ability to apply a gross receipt tax on certain transactions. If you have questions regarding your federal tax return please contact the Internal Revenue Service IRS at 800829-1040 or visit their website at httpswwwirsgov.

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees.

. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. What is South Dakota sales tax. 45 What is South Dakotas.

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. Municipalities may impose a general municipal sales tax rate of up to 2. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax.

Title and registration fees are also paid through your local county treasurers officeYou can also renew your boat registration online or at a DMV Now Kiosk. If you have NEVER paid sales tax they will apply that 4 to the purchase price if new or to the NADA value if more than 6 months old. South Dakota collects a 4 state sales tax rate on the purchase of all.

Sales Use Tax. How are trade-ins taxed. Does South Dakota charge sales tax on vehicles.

These five states do not charge sales tax on cars that are registered there. Taxability of Various Items in South Dakota. Vehicles More What purchases are exempt from the South Dakota sales tax.

Scroll to view the full table. Dealers are not required to collect or pay the motor vehicle excise tax on motor vehicles they sell. What is South Dakotas Sales Tax Rate.

However in addition to the flat state tax rate there are county taxes or local city taxes which can vary significantly depending on which jurisdiction you are in. The South Dakota sales tax and use tax rates are 45. While the South Dakota sales tax of 45 applies to most transactions there are certain items that may be exempt from taxation.

If you have questions regarding your federal tax return W-2 or stimulus checks please contact the Internal Revenue Service IRS at 800829-1040 or visit their website at. If you have NEVER paid sales tax they will apply that 4 to the purchase price if new or to the NADA value if more than 6 months old. Do South Dakota vehicle taxes apply to trade-ins and rebates.

South Dakota does not have an inheritance tax. South Dakota is another popular state for purchasing and registering RVs. South Dakota does not impose a corporate income tax.

You can find these fees further down on the page. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. The South Dakota Department of Revenue administers these taxes.

Does South Dakota charge sales tax on cars. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6 South Dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Does South Dakota have vehicle tax.

The voters of South Dakota. Thus many RV owners will. New Hampshire Delaware Montana Oregon and Alaska.

As the name implies you pay a certain amount for each tire depending on your vehicles weight class and county. One exception is the sale or purchase of a motor vehicle which is subject to the motor vehicle excise tax. Purchasers in South Dakota are charged a 4 excise tax which is much lower than most states and South Dakota has low registration fees as well.

Httpswwwirsgov Inheritance and Estate Taxes. The excise tax which you pay on vehicles in South Dakota is only 4. This table shows the taxability of various goods and services in South Dakota.

How much are vehicle taxes in South Dakota. How much is sales tax on a vehicle in South Dakota. You can find these fees further down on the page.

The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of. The state of South Dakota has relatively simple sales tax rate and utilizes a flat state tax rate. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

Some other states offer the opportunity to buy a vehicle without paying sales tax. Buy a car in Maryland North Carolina Iowa or South Dakota and you. Initiated in 1986 to help subsidize bridge and highway maintenance you pay the South Dakota wheel tax when you are registering your vehicle with the South Dakota Department of Revenue DOR.

Motor Vehicle Sales and Purchases With few exceptions the sale of products and services in South Dakota are subject to sales tax or use tax. For vehicles that are being rented or leased see see taxation of leases and rentals. The State of South Dakota relies heavily upon tax revenues to help provide vital public services from public safety and transportation to health care and education for our citizens.

About the South Dakota Sales Tax. South Dakota is one of seven states that does not impose a state income tax. If you are interested in the sales tax on vehicle sales see the car sales tax page instead.

Sales Tax Exemptions in South Dakota. What Rates may Municipalities Impose. Only some SD counties mandate the.

This page discusses various sales tax exemptions in South Dakota. The excise tax which you pay on vehicles in South Dakota is only 4. Washington DC the nations capital does not charge sales tax on cars either.

Title and register your boat at your local county treasurers office. The state also has no state income tax and a low sales tax 45 and its easy to establish residency in the state. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. In this manner Does South Dakota have personal property tax on vehicles. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees.

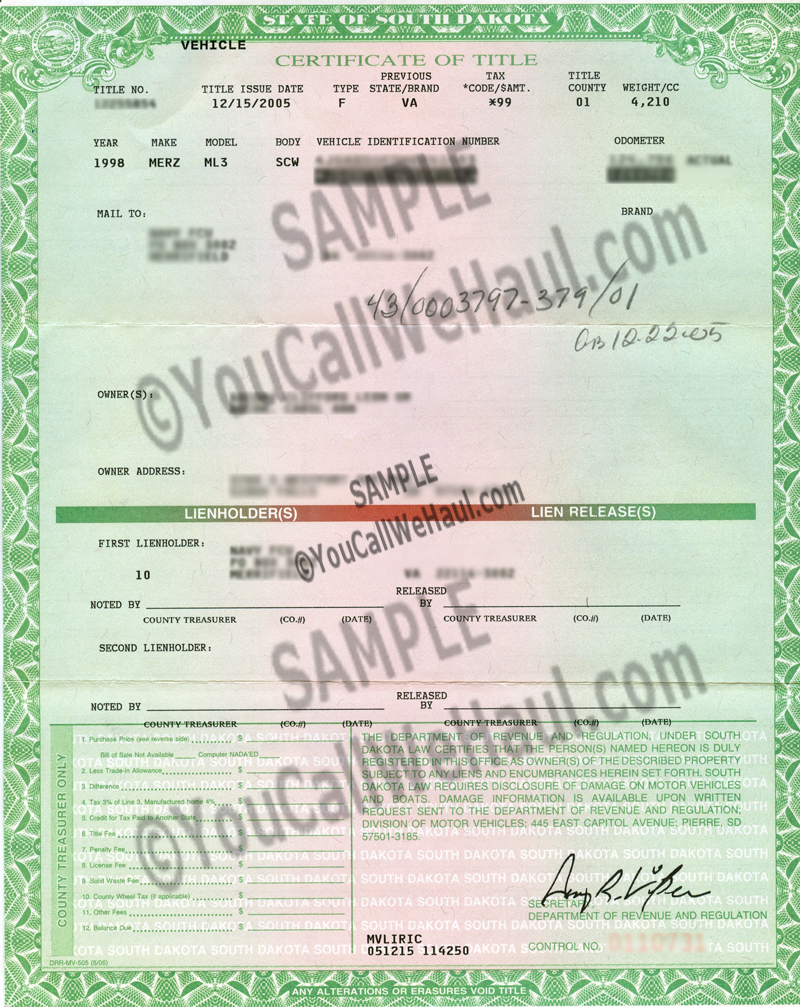

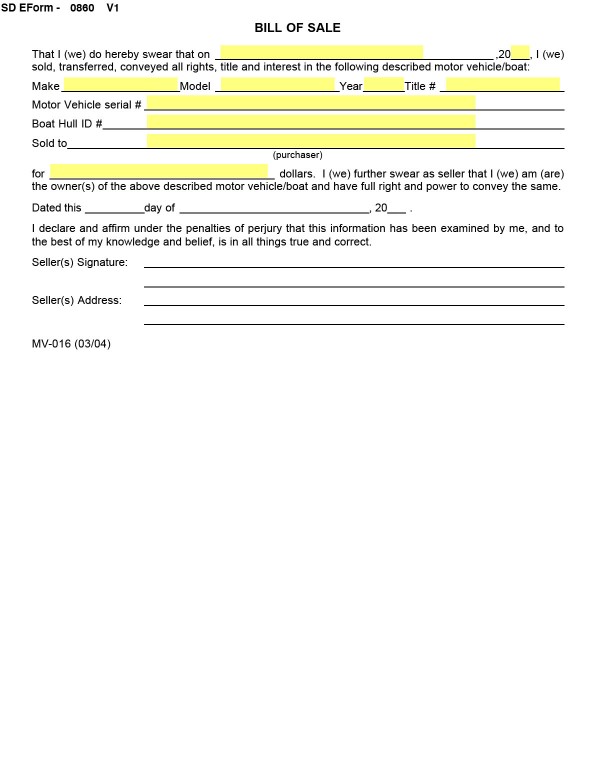

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. However South Dakota does provide a Bill of Sale Form MV-016 for your personal use for motor vehicle sales.

Dealer Vehicle Licenses South Dakota Department Of Revenue

South Dakota Sales Tax Small Business Guide Truic

Motor Vehicle South Dakota Department Of Revenue

Trucking South Dakota Department Of Revenue

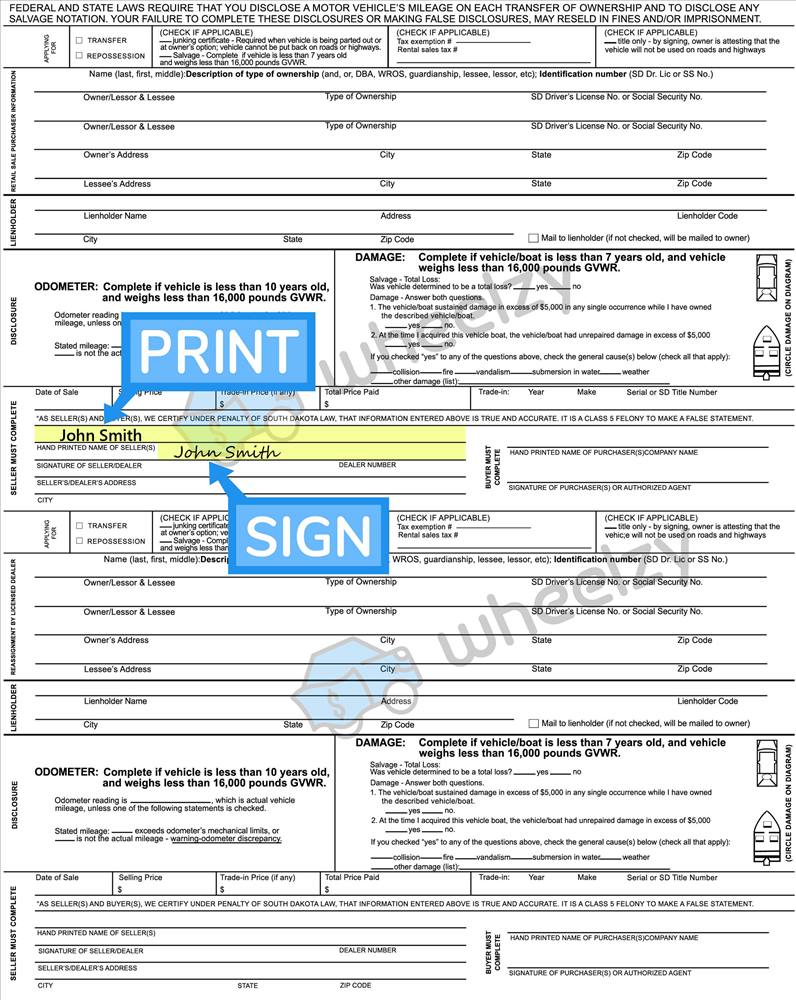

How To Transfer South Dakota Title And Instructions For Filling Out Your Title

Sales Tax On Cars And Vehicles In South Dakota

States With No Sales Tax On Cars

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Sign Your Car Title In South Dakota Including Dmv Title Sample Picture

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Use Tax South Dakota Department Of Revenue

How To Become A South Dakota Resident In 6 Easy Steps

South Dakota Vehicle Title Donation Questions

Vehicle Registration Service No Emissions Or Inspections Dirt Legal

Cars Trucks Vans South Dakota Department Of Revenue

Bills Of Sale In South Dakota The Forms And Facts You Need

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

5 Common Errors When Titling A Vehicle South Dakota Department Of Revenue

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident